Listen below or on the go via Apple Podcasts and Spotify

Delayed jobs report and CPI headline a pivotal data week. (0:17) Coca-Cola, McDonald’s and Cisco lead a busy earnings week. (1:08) Hims & Hers backs off copycat Wegovy. (2:24)

The following is an abridged transcript:

If you look to the stars this week, you’ll see the rare convergence of jobs and inflation.

Due to the government shutdown, the delayed January jobs report is due Wednesday, with the January CPI pushed to Friday.

Last week’s trifecta of jobs data indicated further labor market weakness, with claims and layoffs up and openings down. But economists are still expecting that nonfarm payrolls rose by around 70K last month, with the unemployment rate staying steady at 4.4%.

For the CPI, both headline and core are forecast to post a 0.3% monthly gain, with the annual rates about half a percent above the Fed’s 2% target.

SA analyst Damir Tokic notes that “importers rushed to beat the tariffs in 2025 and stocked up on inventory before the holidays. These inventories have been depleted.”

“Now, retailers are restocking – at higher prices that include the tariffs. Thus, we can now expect to start seeing the full effect of the tariffs,” he said.

On the earnings front, another 78 S&P 500 (SP500) companies report, including three Dow Industrials (DJI) components: Coca-Cola (KO), McDonald’s (MCD) and Cisco (CSCO). The Dow topped 50K for the first time last week.

On Coca-Cola, Seeking Alpha analyst Agar Capital says the company “will continue to do what it has historically done: produce steady growth, protect margins, and withstand a difficult macro environment.”

Also on the earnings calendar:

- ON Semiconductor (ON) and Loews (L) report Monday.

- Joining Coca-Cola on Tuesday are AstraZeneca (AZN), Gilead (GILD) and Ford (F).

- Along with Cisco and McDonald’s, T-Mobile US (TMUS) weighs in on Wednesday.

- Applied Materials (AMAT) and British American Tobacco (BTI) report Thursday.

In the news this weekend, it’s Super Sunday, and the internet is echoing with chats about who will emerge victorious… OpenAI (OPENAI) or Anthropic (ANTHRO).

The AI giants are taking their rivalry to the Super Bowl LX audience, with Anthropic taking an open jab at OpenAI’s new ad model — and OpenAI countering with its pitch that it’s the future of AI.

Anheuser-Busch InBev (BUD) is set to be the biggest advertiser, with 2 minutes and 30 seconds of national spots and 45 seconds of regional ads.

Other advertisers include Instacart (CART), Rocket Mortgage (RKT), PepsiCo (PEP), direct-to-patient telehealth company Ro, Liquid Death, Svedka vodka, Cadillac and Meta Platforms (META).

Meanwhile, following pressure from Novo Nordisk (NVO) and the FDA, Hims & Hers Health (HIMS) says it will no longer offer a compounded version of Novo’s Wegovy pill for weight loss.

“Since launching the compounded semaglutide pill on our platform, we’ve had constructive conversations with stakeholders across the industry,” the company posted. “As a result, we have decided to stop offering access to this treatment.”

On Friday, FDA Commissioner Marty Makary said he would target companies manufacturing mass-market copycat drugs.

And in a surprise move, Will Lewis, the chief executive and publisher of The Washington Post, has stepped down — just days after the newspaper slashed about a third of its workforce.

Lewis said he’s taking the step “in order to ensure the sustainable future of The Post.” In his email, he thanked only owner Jeff Bezos, and did not acknowledge the newsroom.

For income investors, Apple (AAPL) and Las Vegas Sands (LVS) go ex-dividend on Monday. Apple pays out Feb. 12, and Las Vegas Sands pays out Feb. 18.

IBM (IBM) goes ex-dividend Tuesday, with a March 10 payout date.

And Eli Lilly (LLY) goes ex-dividend Friday — also paying out March 10.

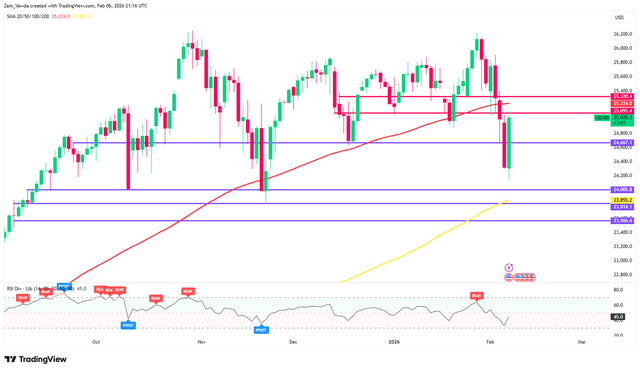

And the chart to watch this week is the Nasdaq 100 (NDX).

OANDA Group says the index staged a significant technical recovery on Friday, and that momentum may be shifting back toward the bulls.

The next test is whether the 14-day RSI can push back above 50 — and whether the index can reclaim the 100-day moving average, which sits around 25,224.

Nasdaq-100

Read the full article here